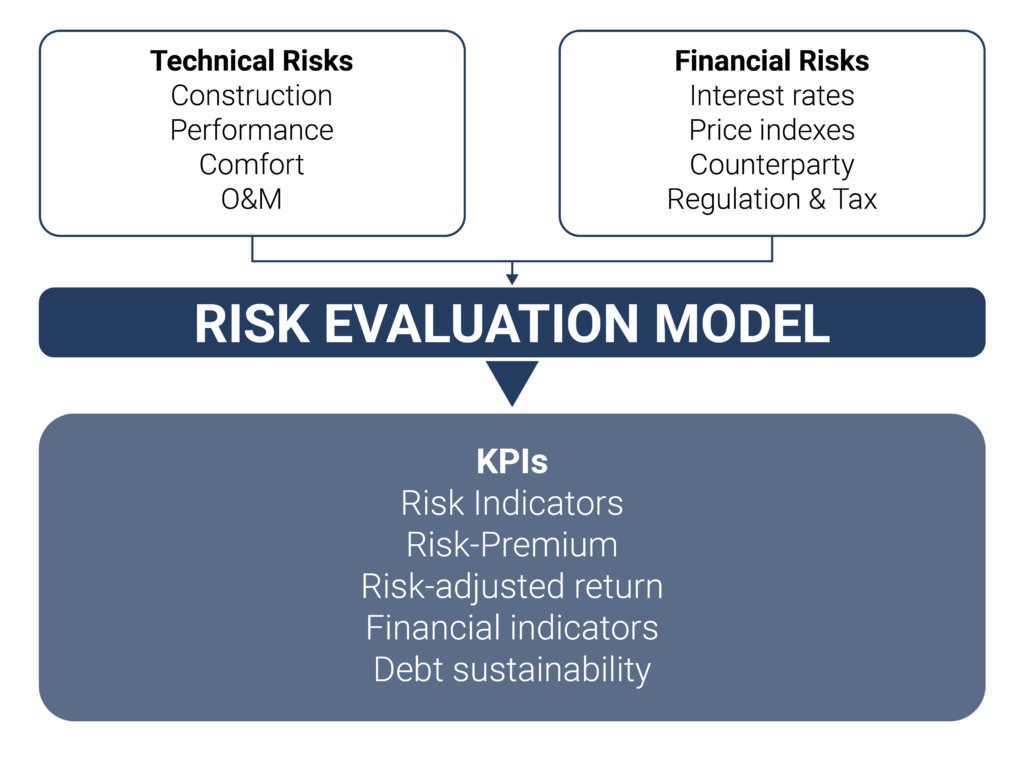

The perception of risk surrounding building renovation operations is an important driver in most of the energy efficiency related financing operations. However, investment decisions in building renovation are still largely based on empirical methods which rely solely on company business specific experiences.

The investment market is calling for solid knowledge-based evaluation methods to perform technical/ financial due-diligence and evaluate financial operations related to energy-efficient buildings.

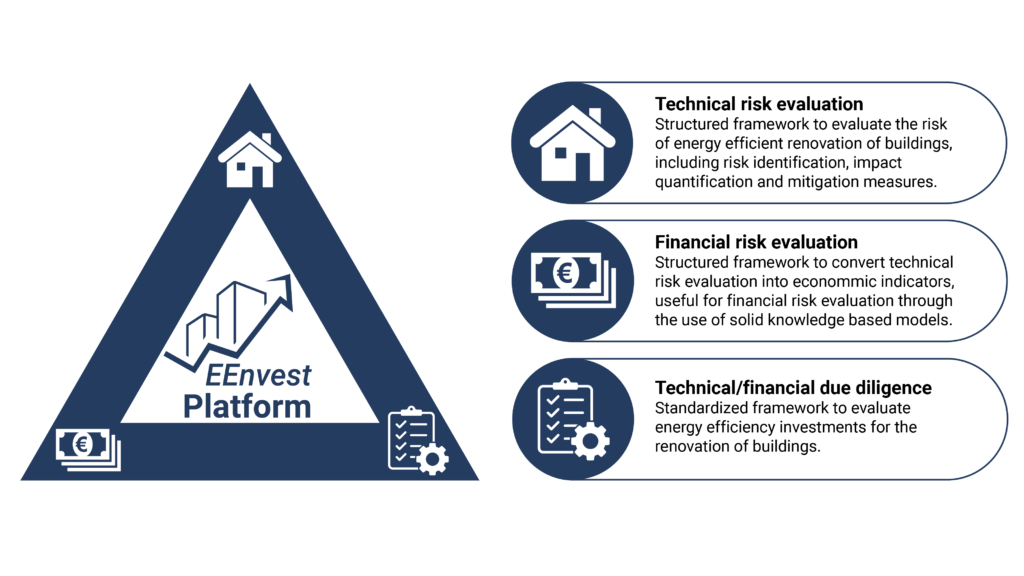

The main objective of EENVEST is to secure investors´ trust in energy efficiency actions for existing buildings, through the development of a combined technical-financial risk evaluation framework focused on the renovation of commercial buildings.

Development of a comprehensive technical risk evaluation framework for the whole set of considered energy efficiency investments, with a focus on building energy performance driven renovation. The framework will allow investors to evaluate risk connected to energy efficiency on the technical side without the need to go in depth into building energy performance aspects.

Boosting energy efficiency financings by making them able to equally compete with other categories of investments, thanks to both technical risk identification, quantification and mitigation, and financial risk assessment.

Robust and innovative energy efficiency risk rating model that will be the basis for the investment evaluation platform

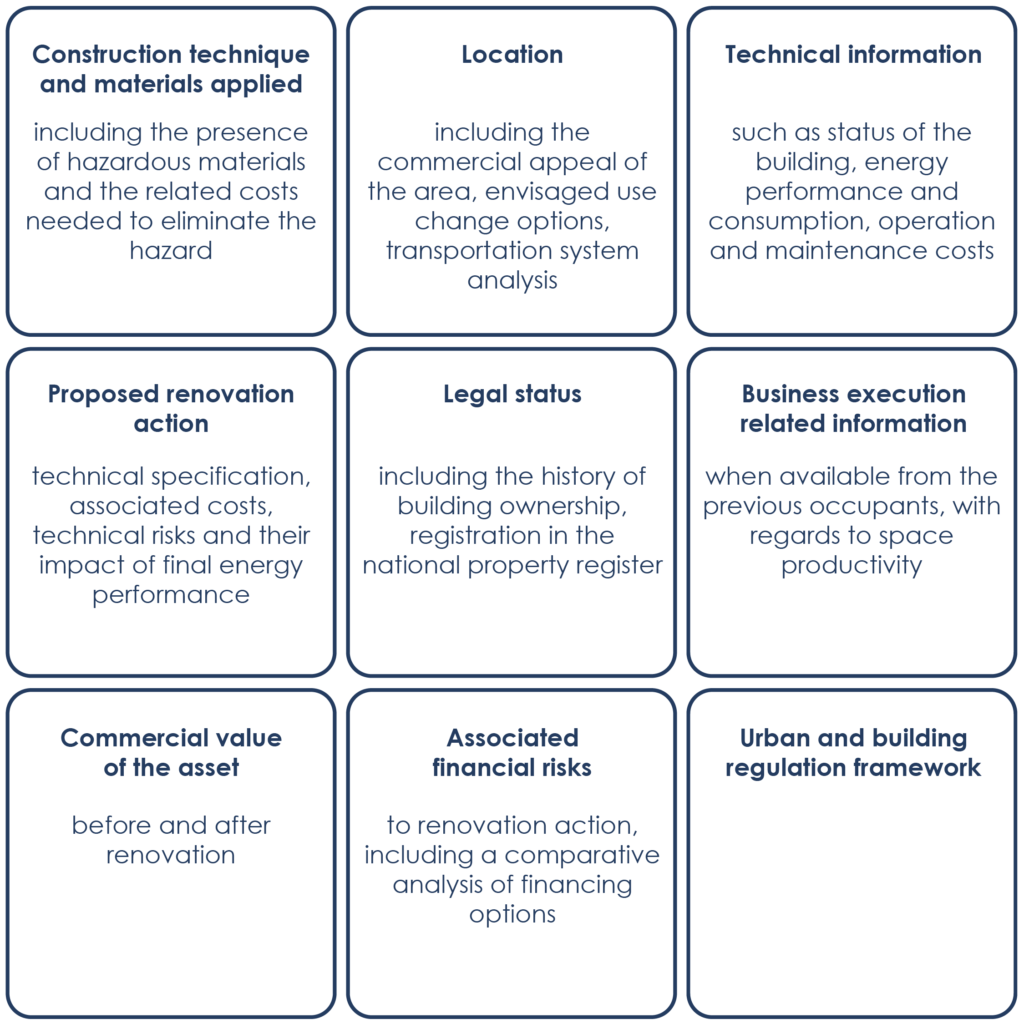

The technical/financial due diligence framework will include guidelines on at least the following parameters:

The innovative added value of the EENVEST platform is to provide to the user with a structured set of diverse data (technical, performance, procurement, investment, financial) in a systematic and user-ready fashion with a privileged view from the investors´ side, to facilitate their decision-making process.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features.

Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.